sales tax rate in tulsa ok

Some cities and local. What is the sales tax rate in Tulsa OK.

How Oklahoma Taxes Compare Oklahoma Policy Institute

How much is tax by the dollar in Tulsa Oklahoma.

. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. The Bixby Oklahoma sales tax is 892 consisting of 450 Oklahoma state sales tax and 442 Bixby local sales taxesThe local sales tax consists of a 037 county sales tax and a 405. Avalara provides supported pre-built integration.

The December 2020 total local sales tax rate was also 4867. Tulsa Sales Tax Rates for 2022 Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. Average Sales Tax With Local.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Tulsa has parts of it located within Creek County Osage. The average cumulative sales tax rate in Tulsa Oklahoma is 831.

With local taxes the total sales tax rate is between 4500 and 11500. For the 2020 tax year Oklahomas top income tax rate is 5. Oklahoma OK Sales Tax Rates by City The state sales tax rate in Oklahoma is 4500.

The December 2020 total local sales tax rate was also 8517. As far as all cities towns and locations go the place with. The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales.

State of Oklahoma 45 Tulsa County 0367 City 365. Ad Integrates Directly w Industry-Leading ERPs. State of Oklahoma 45.

Tulsa County OK Sales Tax Rate The current total local sales tax rate in Tulsa County OK is 4867. This includes the rates on the state county city and special levels. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax.

Lower sales tax than 69 of Oklahoma localities 2483 lower than the maximum sales tax in OK The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa. The average cumulative sales tax rate between all of them is 828. The total sales tax rate charged within the city limits of Claremore is.

What is the sales tax rate in Claremore OK. What is the lodging tax rate. Inside the City limits.

The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365. The Tulsa County sales tax rate is. The Tulsa County Sales Tax is 0367 A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax.

The 2018 United States Supreme Court decision in South Dakota v. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. The tax must be paid on the occupancy or the right of occupancy of rooms in a hotel.

The City of Tulsa imposes a lodging tax of 5 percent. City 365. Tulsa OK Sales Tax Rate The current total local sales tax rate in Tulsa OK is 8517.

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does. Some cities and local governments in Tulsa County. Tulsa County 0367.

The Oklahoma state sales tax rate is currently. There are a total of 470 local tax. 8764 Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65.

Reduce audit risk as your business gets more complex. The most populous location in Tulsa County Oklahoma is Tulsa.

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

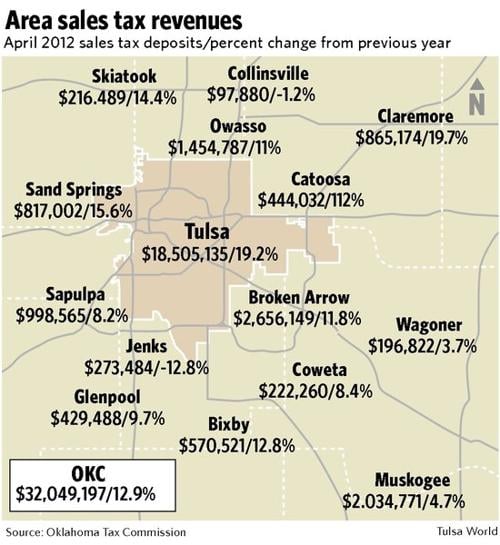

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

Oklahoma Sales Tax Information Sales Tax Rates And Deadlines

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

History Of Jenks Oklahoma Best Places To Live Jenks Night Pictures

Total Sales Tax Per Dollar By City Oklahoma Watch

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

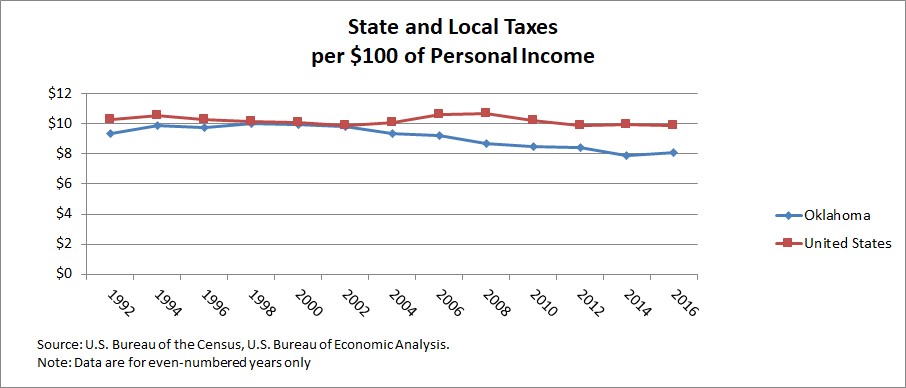

Oklahoma Tax History Oklahoma Policy Institute

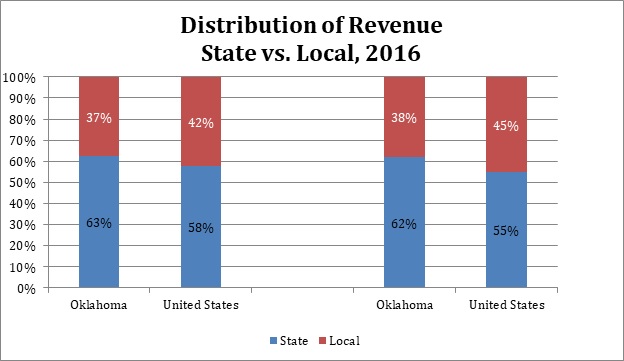

State And Local Tax Distribution Oklahoma Policy Institute

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Sales And Use Tax Rate Locator